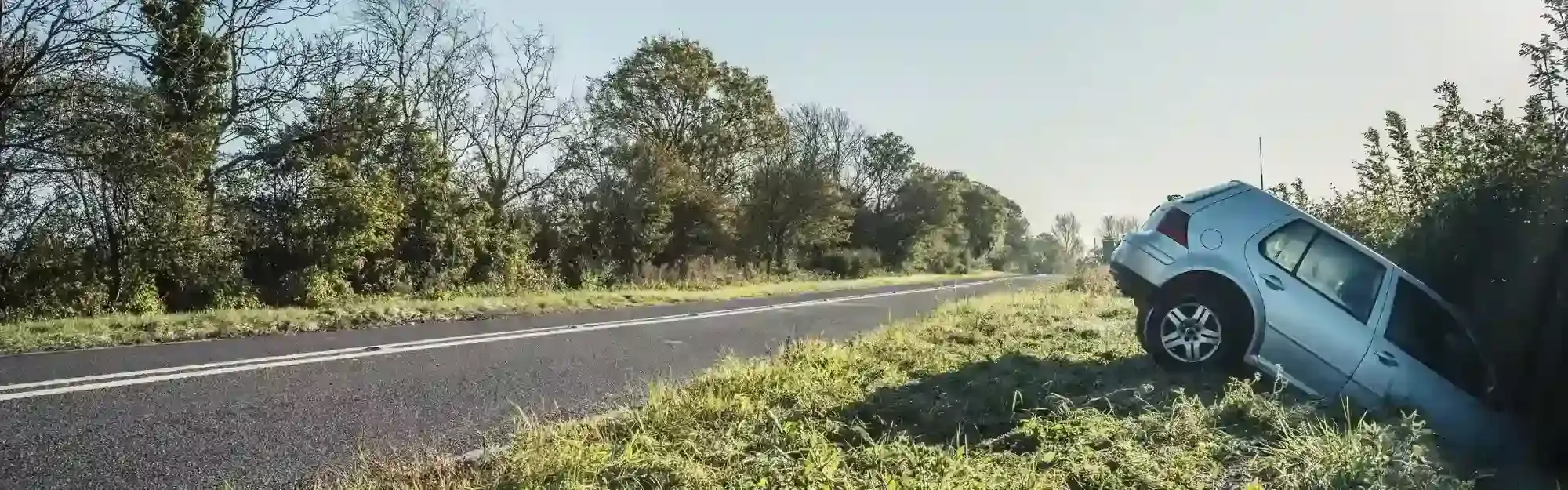

Accident Care

With RAC Business Breakdown cover you get FREE access to an end-to-end Accident Management service.

Unlike most breakdown providers, if you have an accident on the road we'll come to your rescue - even if the accident was your fault.

Had an accident? - Call us first on 0333 2000 999

Not at fault?

If you're involved in an accident that wasn't your fault, as an RAC Business Breakdown customer not only will we rescue you if you can't get your vehicle moving, we'll also manage your insurance claim from start to finish.

This includes:

-

Replacement or repairs to your vehicle

With your permission, we can make arrangements for a replacement vehicle while yours is off the road, or for repairs to get you back up and running. Where possible, we'll incorporate the costs of repairs or a replacement vehicle into your claim.

-

Personal Injury

If you are injured as a result of your accident, we can advise you on making a claim for personal injury, and we’ll ensure that any consultations, medical costs or rehabilitation for your injuries is fully considered.

-

Loss of earnings

We'll also assess any loss of earnings or costs incurred if you or your vehicle are out of action as a result of your accident. Any additional costs of doing business with your vehicle off the road, such as replacement transport or missed deliveries, will also be recorded. -

Damage to property or goods

We'll seek to recover the costs of any damage caused to the contents of your vehicle too. If you have tools, equipment, property or perishable and non-perishable goods in your vehicle that are damaged in the accident, we'll include this in your claim.

In addition to managing your claim on your behalf, 24/7 legal advice will be available to you throughout the claims process, completely free.

At fault?

Accidents happen, and if you are at fault don't worry, we're still here to help.

Even if you are at fault for an accident, as an RAC Business Breakdown customer, unlike most breakdown providers, we can still come and recover your vehicle. In addition to recovery, you can also benefit from free accident and legal advice.

Following your accident you'll have access to our free RAC legal advice hotline. Our advisors are on hand 24/7 to help talk you through the end-to-end process of managing your accident and will advise and support you on; your legal position, managing your claim, and your options for keeping costs at a minimum - such as alternatives to paying your policy excess, or losing your no claims bonus.

Get in touch

Prefer to speak to one of our team? No problem, enquire below or give us a call on 0330 159 0975

Get a quote

Build your cover now to get a quote in minutes.

For our most up to date pricing, click get a quote below to build your cover.

Frequently Asked Questions

If you are involved in an accident on the road, remember to call us first. We will then be able to make recovery arrangements immediately and can take care of your insurance claim from start to finish once we have assessed liability for the accident.

In the event of an accident, RAC Business Breakdown customers will be charged as per their agreement for recovery. Our policy terms and conditions can be found here. If the accident was not your fault, we may seek to recover the cost of your recovery from the at fault party as part of your claim. If you are at fault, we will charge you accordingly for recovery, it is then at your discretion whether to include this in your insurance claim.

Any medical costs or rehabilitation for injuries sustained in a non-fault accident can be included in your claim. If you are unable to work as a result of your injuries, loss of earnings and additional costs incurred by your business will be assessed and also included as part of your claim.

If you have tools or equipment, or are transporting property at the time of your accident, and that property or equipment is damaged you will need to prove the value of that property in order for us to include it in your claim.

If you are at fault for an accident, unlike most breakdown providers, we can still recover your vehicle for you. In addition to recovery, you can also still benefit from our 24/7 legal advice helpline. Our advisors can talk you through your claim, your legal position, and can even advise you how to keep your costs to a minimum.