RAC Emergency Vehicle Breakdown Cover

You know you're getting breakdown cover you can trust with us – we've been doing this since 1897! Our expert patrols get to you in 60 mins or less, and we fix 4/5 on the spot. Our cover is 24/7, 365 days of the year. Plus, our standard cover for business breakdown cover includes emergency vehicles including ambulances, police vehicles (and more). Meaning, your business can keep moving.

Compare our blue light breakdown cover

At the RAC, we tailor your cover to your business. We exclusively offer flexible monthly payments for all types business breakdown cover.

Roadside & At Home

We'll rescue you from anywhere in the UK. If we can't fix you, we'll give you a 10 mile tow.

-

Business cover, with personal use

-

We'll send help to fix your vehicle if it breaks down anywhere in the UK.

-

Repeat callouts for the same fault won't be covered.

-

You'll have a £300 preapproved parts limit. There's no need to arrange payment at the roadside, you'll be sent an invoice once the repairs are complete.

-

If we can't fix you, we'll tow your vehicle up to 10-miles.

Roadside, Recovery & At Home

If we can't fix your vehicle, we'll take you, your vehicle and your passengers anywhere in the UK.†

-

Business cover, with personal use

-

We'll send help to fix your vehicle if it breaks down anywhere in the UK.

-

Repeat callouts for the same fault won't be covered.

-

You'll have a £300 preapproved parts limit. There's no need to arrange payment at the roadside, you'll be sent an invoice once the repairs are complete.

-

With Recovery, if we can't fix your vehicle at the roadside, we'll recover you, your vehicle and passengers anywhere in the UK. Cover starts 24 hours after your cover start date.

Why choose us?

We get to most breakdowns in 60 minutes or less.

We'll fix you on the spot – saving you time and money on a trip to the garage.

Expert advice to help you back on the road quickly if you have an accident**

Avoid Big bills

Battery Replace

Get a new battery if we can't recharge yours - worth up to £600.

Legal Expense Insurance

If you have an accident that wasn't your fault, we'll help you claim back losses your motor insurance doesn't cover.

Puncture? No problem - you'll get up to £150 per tyre to repair or replace your damaged tyre.

Get in touch

Prefer to speak to one of our team? No problem, enquire below or give us a call on 0330 159 0975

Get a quote

Build your cover now to get a quote in minutes.

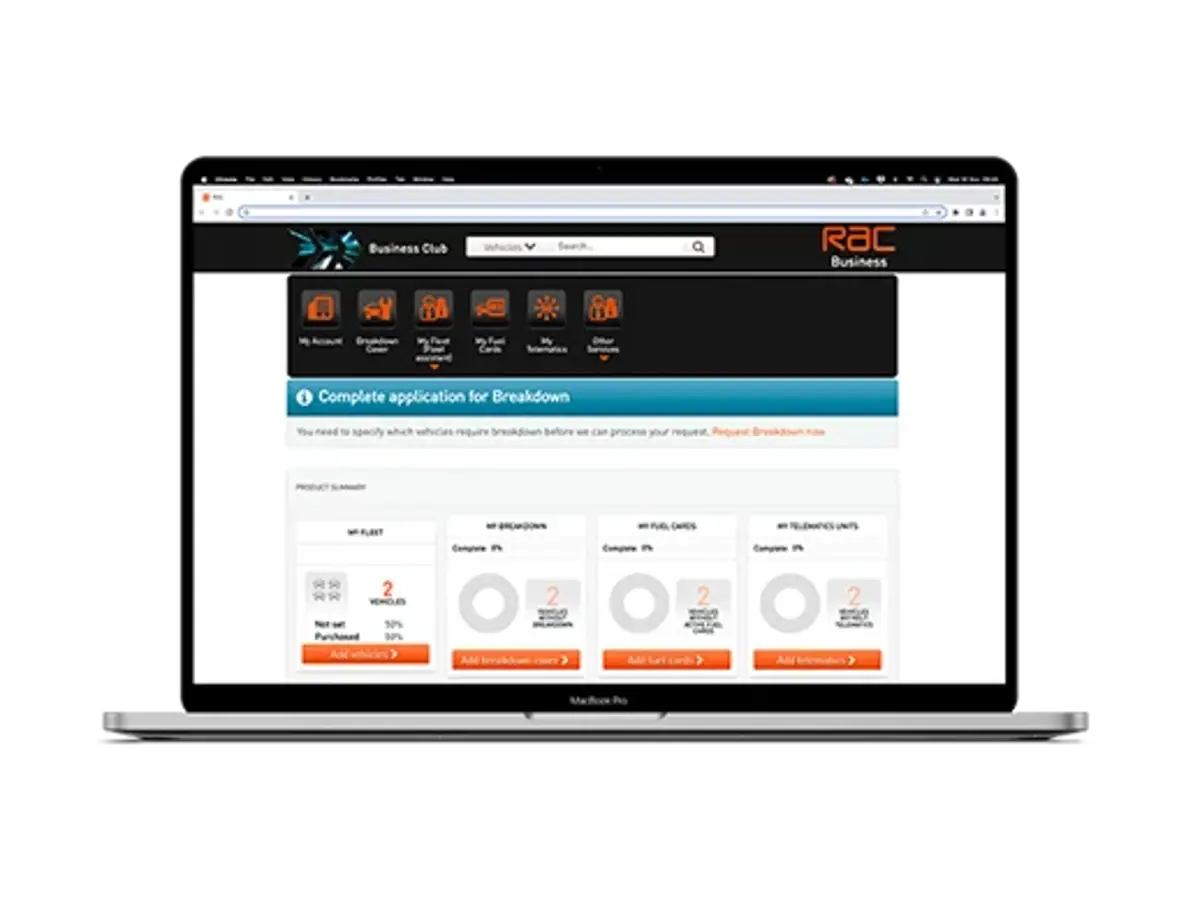

RAC Business Club

RAC Business Club puts you in complete control of your business vehicles. This easy to use online tool with help you managed your vehicles more efficiently.

- Keep your drivers and vehicles safe on the road with our comprehensive duty of care library

- Manage MOTs, servicing and repairs online with the RAC Approved Garage Network

- Set up renewal alerts for your vehicles to ensure you’ll always be covered

- View your breakdown policy online and update, amend or upgrade your cover whenever you want

What business breakdown cover do you need?

We cover a range of businesses and vehicle types.

Here at RAC Business, our standard cover includes emergency vehicles such as ambulances, police cars and more. Cover starts from £11 during a non-offer period.

Here at RAC Business we can cover all fleet sizes. For up to 100 vehicles you can purchase online or you can contact our friendly team for a quote over 100 on 0330 159 8789

Here at the RAC we offer breakdown cover for all types of vehicles including vans and specialist vehicles.You can also choose a mix of vehicle types, with our mixed fleet cover.

For our Business customers at the RAC we offer a range of breakdown cover levels tailored to your business needs. Including Fleet, Van, Truck, Emergency Vehicle and more. Get in touch today.

As a member or non-member in a break down you can contact the RAC on 0330 159 0975. Or alternatively you can you report your breakdown on the My RAC app.

You can get specialised fleet insurance tailored to your business needs with the RAC. With RAC Fleet Insurance, you’re covered by our specialist partners – experts in providing insurance cover to businesses operating vehicle fleets in sectors that include building, construction, distribution, and logistics. Their team of insurance industry specialists will work with you to help reduce both the frequency and severity of accidents, helping to keep the wheels of your business turning.

Save up to 8p on every litre of diesel purchased across our exclusive Discount Diesel network^^. Plus, get access to low cost supermarket locations to reduce your fuel costs further.

^^Savings on diesel can be made at participating Discount Diesel sites on our network when the card is swiped.